Sixteen months of Boeing 737 production. This is the number of orders China’s competitor to Boeing (NYSE:BA), the COMAC C919, manufactured by state-run COMAC Corporation, has already amassed, and the aircraft is just getting off the ground.

As the COMAC C919 takes to the skies, many are writing off its ability to be a threat to Airbus (OTCPK:EADSF) or Boeing and their respective bestselling A320 and 737 models. I believe however investors are ignoring five strong reasons why the COMAC C919 threat should be taken more seriously.

It Is Designed To Win

COMAC has had a shaky start in its aerospace ambitions. The Chinese state-owned aerospace firm first ventured into the commercial aircraft market with the ARJ21, an aircraft based on plans purchased from American aerospace firm McDonnell Douglas.

Despite the head start the project got from purchasing the plans and tooling, the aircraft suffered delay after delay, finally entering service 14 years after the project began.

Even today, almost 1 year after entry into service, there are only 2 aircraft in service. Much of the development issues stemmed from the fact that COMAC wanted to take the American planes they bought and substitute many parts, other than the engines and wings with its own Chinese parts, to build a “Chinese aircraft.”

This time around COMAC has learned its lesson and is being more pragmatic with much of the aircraft comprised of American and foreign parts assembled in China. The decision at COMAC to instead use foreign suppliers and rely on their extensive experience in the aerospace industry should ensure this aircraft is much more commercially successful than its predecessor.

It Is Backed By The Chinese Government

It is hard to emphasize just how much power the Chinese government has in ensuring the commercial success of its projects, but you can take a look at a comparable program to get an idea of the influence Beijing has in a project like this.

The Bombardier (OTCQX:BDRBF) CSeries, an aircraft with leading technology, made by a company which has aircraft operating around the world has racked up only 360 orders. Bombardier finally got relief when Delta Air Lines (DAL) ordered the aircraft, an order I previously wrote about here as one that validated the aircraft. In order to win that sale, however, Bombardier had to take a loss on the entire order.

By comparison, the COMAC ARJ19, an aircraft aerospace analyst Richard Aboulafia said “any airline forced to operate this jet will be at a severe competitive disadvantage against any airline with modern aircraft” easily racked up 302 orders, almost all from Chinese airlines.

The Chinese government places pressure on its domestic airlines to support its domestic aircraft programs, something that is illegal but something most seem willing to overlook, likely out of fear of retaliation from the Chinese government.

The size of the Chinese market alone could support 5,110 orders for aircraft this size over the next 20 years and is the first trillion dollar aviation market according to recent Boeing research. With a market this size and Chinese orders accounting for around one-fifth of Boeing’s backlog, even a small percentage of these orders being swapped in favor of the C919 could have a measurable impact on Boeing.

Diplomatic Sales

Expect the aircraft to sell well in the Asia Pacific region and African markets as well as to countries that have close relations with China. These sort of diplomatic sales are more common than not throughout the world among airlines that are state-owned or are under strong state influence.

As an example, Lion Air was reported as saying that the major order it announced when Obama visited Indonesia in 2011 was not one that it desired but one that the government pressured it to place in order to improve inter-governmental relations between Indonesia and the United States. One only needs to look at the recent flurry of order activity that many foreign leaders are bringing Boeing when they meet with President Trump. These types of orders are designed to improve diplomatic relations and balance trade deficits.

For COMAC, many of these diplomatic sales are likely to come from countries eager to build stronger relations with China. These countries are likely to be emerging markets with some of the fastest economic growth in the world in Africa, Asia, and Latin America. For Boeing, much of its future order growth is coming from these emerging markets, so losing sales here to COMAC could hurt Boeing’s long-term growth potential in the single-aisle airplane market.

Airport Slots

This is likely to be a big card the Chinese will play in order to drive sales outside of countries that are close diplomatically and to airlines that operate on a more commercial basis.

As the number of middle class in China continues to grow, so will the demand for more flights to and from China. China is a market of growing importance for airlines worldwide and one that airlines are willing to invest substantial money in in order to ensure their long-term success.

American Airlines (AAL) and Delta Air Lines alone have invested over half a billion dollars in partnerships in the Chinese market over the past two years. When slots start to run out at key airports, the Chinese government may give favorable treatment to airlines that buy the C919 over airlines that show no interest in it.

This already happened in France when the CEO of Spanish airline Vueling Airlines stated, “It would be crazy to decide on a manufacturer without taking into account the effects it may have on our network development”, as his airline was suspected of favoring Airbus aircraft in order to get more access to slots in Paris.

Low Oil

The advent of low oil is another major blow to the Boeing 737. When oil is high, airlines put a major emphasis on purchasing the aircraft with the latest technology that will burn the least amount of fuel. When oil prices are lower, the technology of the aircraft becomes less of a priority, while the purchase price of the equipment is a much bigger deciding factor.

This is why airlines such as Delta are more inclined to purchase second hand, older aircraft, as the lower purchase cost in these times substantially outweighs the cost of the increased fuel they consume. The COMAC C919 is likely to have a lower price tag than the Boeing 737, so if oil prices look to stay relatively low for the foreseeable future, it could drive additional orders to it.

Made In China Isn’t So Crazy

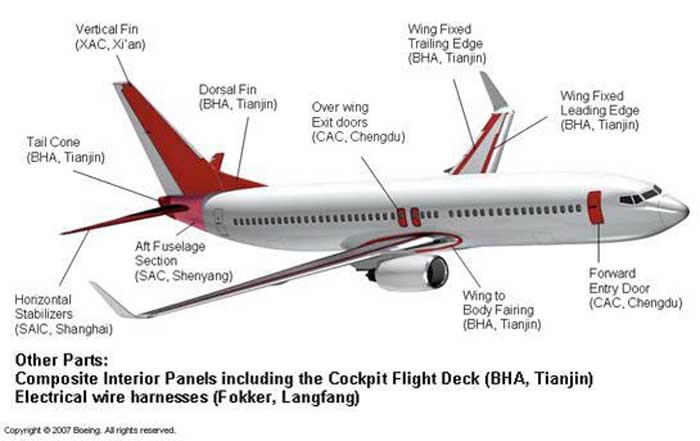

An aircraft made in China is not such a crazy prospect. Delta Air Lines operates McDonnell MD-90 aircraft that were manufactured in China. Airbus also operates an assembly line that has been manufacturing A320 aircraft in the country for 8 years now, with a planned widebody A330 completion center in the works. In addition, many parts for Airbus and Boeing aircraft are sourced from China as the image above shows.

There is no point comparing the tech specs of the COMAC C919 with offerings from Airbus and Boeing. The COMAC C919 offers specs that are close enough to the competing Airbus and Boeing offerings that many will be willing to overlook the inferior specifications if purchasing the aircraft can deliver something much greater.

For some state-owned and state influenced airlines, this will be enhanced intergovernmental relations between the Chinese government and their own. For other airlines, this will be the access to slots at key Chinese airports at favorable times. Some airlines may be swayed by the low purchase price, while other Chinese airlines will buy the aircraft due to state pressure.

This is COMAC’s first major commercial aircraft, and next up will be two twin-aisle models to compete against Boeing’s 787 and highest margin 777 aircraft. Boeing investors should watch developments with the C919 carefully, particularly at this week’s Paris airshow and not simply write all Chinese aircraft off as another ARJ21 debacle.